Introduction

Buying your first home can be intimidating especially for first-time home buyer. The process of buying a home is not as easy as you thought. That exciting feeling you get when thinking about buying your first home is definitely a dream come true for many of us. And as we speak about buying a home there are some first-time home buyer mistakes you need to avoid.

While shopping for a house there are some common mistakes you need to watch out for so later on there won’t be any regret. Knowing what you should do and what mistakes you shouldn’t do is important while you are purchasing your dream house.

11 FIRST-TIME HOME BUYER MISTAKES TO AVOID

Here are 11 common first-time home buyer mistakes to avoid:

- Not checking the first time home buyer program

- Spending more than you can afford

- Drain your savings

- Disregarding FHA loans, USDA loans, and Va loans

- Underestimating the extra costs of homeownership

- Leave out home inspections

- Not ready for the mortgage process

- Overlook the expenses for repair and renovations

- Not consulting with many lenders

- Buying home based on emotions

- Doing everything by yourself

1. Not checking the first time home buyer program

This is one of the most common mistakes for every first-time home buyer, you need to avoid. There are plenty of mortgage lenders that don’t require a down payment. If you are looking for a housing loan look for the government program, Federal Housing Administration loans (FHA loans) give out loans for low credit scores and the down payment is only 3.5%.

2. Spending more than you can afford

While shopping for a home it’s easy to get carried away as you will come across so many beautiful houses. There will be tons of beautiful homes painted in bright colors. Your dream house might be out of your budget, don’t make the mistake of going out of your budget to buy a home you can barely afford. Many first-time home buyers make the mistake of overextending their budget and end up in foreclosure homes as the financial falls.

Buy house you can afford don’t fall for what others tell you to buy, as you know your financial status far better than anyone else.

3. Drain your savings

The biggest first-time homebuyer mistake is spending all their hard earned savings on closing costs and down payment.

Just because you don’t want to pay a 20% down payment don’t be quick to scrape away all your savings for closing costs, that’s not a good idea. You need to keep some an emergency fund for at least 3 months.

4. Disregarding FHA loans, USDA loans, and Va loans

As a first-time homebuyer, you might not have enough cash or savings to buy your first home. In times like this government programs for loans can be handy as they give loans with a low down payment or no down payment.

Federal housing administration (FHA Loans) offers mortgage rate as low as 3.5%, government loans optional should be your first approach if you’re looking for loan programs.

[Learn how To Connect With Multiple Lenders With FHA Rate Guide]

5. Underestimating the extra costs of homeownership

We often overlook the hidden costs of homeownership, as a homeowner, you will have to pay extra money for property taxes, homeowners insurance, house maintenance, monthly utility, mortgage insurance, repairs, monthly mortgage payment, and more.

6. Leave out home inspections

A home inspection is one of the most important steps while buying a home. Being a first-time home buyer it’s hard to figure out everything by yourself. If you are going for home inspections take along with a professional home inspector. Why you have to let a professional inspector inspect your new home is because they know a lot more about the house, these professionals can notice things that most of us don’t.

7. Not ready for the mortgage process

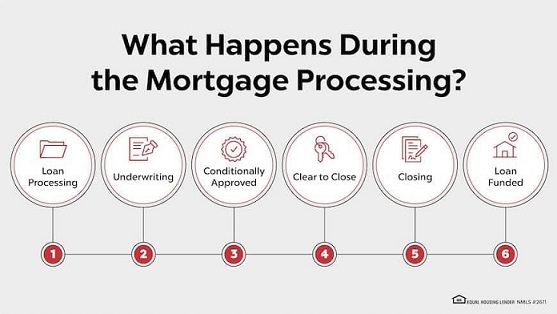

At mortgage preapproval, the mortgage lender will check your credit score report to make sure that you have a good credit score and that there is nothing wrong with your financial status. Your mortgage lender will ask for bank statements, tax returns, pay stubs, and other proof of income. To get a mortgage loan try to maintain good credit and all your documents are well prepared. Check your credit before applying for a mortgage loan. [Learn How To Lower Your Mortgage Payment?]

8. Overlook the expenses for repair and renovations

Everything has become so expensive these days, whether your house needs some repair or needs to be renovated it gonna cost you a lot. If your new home needs big repairing or needs to be renovated, a good contractor may help you estimate the cost. In case, your new home has lots of repairs to be made, calculate the cost of the repair.

Let your seller know about the repairing cost, ask your seller to deduct the repairing cost, or ask your seller to repair it before giving you the house key.

9. Not consulting with many mortgage lenders

Not exploring your loans optional is like throwing away a winning game. Who says you can only talk to a single lender, you have a lot of lender options. Some mortgage lenders and brokers offer lower interest rates for a mortgage loan. Talk with different lenders and pick the one who you can trust and who is ready to lend you a mortgage loan at a lower rate. As a first-time home buyer avoid this mistake of approaching only one lender.

[Connect With Multiple Lenders With FHA Rate Guide]10. Buying a home based on emotions

That exciting feeling you get when you imagine owning your home might actually make you pay more than you should.

If buying your own home one day was one of your life goals while buying the first home you might get emotionally attached to the house by already imagining you and your family living in that house that is not yours yet.

This emotion will mess up your head and you will end up overpaying the house.

11. Doing everything by yourself

Unlike going to buy your groceries buying a home is a long process, and you need a trusted real estate agent’s guidance.

Of course, you can do your own research about what you need to do while buying a home, what mistakes you need to avoid, and more. There are things you can do by yourself but buying a home is a big investment and to get the best home that will fit your lifestyle is to leave the professional job to the professional. Decision-making is up to you but you will need professional help to walk you through it.