Are you ready to buy a property but worried that you don’t generate enough income to qualify for the loan? This can put you in a tricky situation and become a big obstacle in the pursuit of your dreams. Read this article to know How to get a mortgage approved even for low income.

Table of Contents

Introduction

The mortgage loan application process alone can be a really daunting task for most people especially for people planning to buy a house for the first time or a commercial space. Because unlike other loans, it takes a pretty good amount of time and you also have to carefully fill up all the details correctly. This includes your name, age, address, your employment status, the property that you are buying, your social security, the interest rate, your assets, all the debts you have on your credit reports and so on.

This whole application process takes time as it carefully analyzes your current situation and check whether you qualify and if you will be able to repay the mortgage loan taken, on time. Before your loan is sanctioned, you will have to provide your asset as collateral to the lender. If you are unable to pay back on time, the lender has the full right to do whatever it wishes, with your asset. In most cases, the lender sells off the borrower’s asset to compensate for the loan borrowed.

This can be a really difficult situation for low income earners if they don’t pay off their debt on time. This is because not only will they have to pay back the loan in double as the interest rate goes up but they will also lose access to their properties like their house or land, which was put up as collateral security, to the lender.

However, the good news is that, there are now many types of mortgage loans available for the low-income group. You can now own a home or a commercial property even if you don’t make a good amount of money.

What to do before applying For a Mortgage Loan?

Here’s a list of what you can do, before applying for any mortgage loan. #mortgageloan

Know your credit score and debt ratio

The most important step before you apply for a mortgage is, to know your credit score and debt ratio. Once you get your credit report, check your credit score and look at your debts. This is because all the debts that are on your credit report are the debts that they are going to use on your mortgage application. Therefore, you can add up the credit cards, the auto loans, student loan or whatever loans are shown in your credit report. In addition, add up the monthly payments and divide them with your income so that you will have your debt ratio. Some companies may call this as Debt-To-Income-Ratio or DTI. It is important that, you know this and you can do so, by just pulling out your credit score report.

Plan your budget

Know and plan your budget wisely and how big of a loan you can afford. It is important that, you don’t spend more than 25% of your income on your mortgage payment. Also, the mortgage loan that you are about to take plus all your other debts should not exceed more than 40% of your income at the least, especially if you belong to the low-income category.

Improve your DTI ratio

Try to improve your DTI at the very least even if you are not making sufficient money. This will give you a better chance of mortgage approval with low income. You can start by paying off your other debts like the student loans or auto loans if there are such. This includes your credit card bills and any other types of loan that you have borrowed. Paying off your debts will help you to improve your DTI. And, it will also boost your credit score, which is also an important factor to determine your mortgage application.

What is Debt-To-Income Ratio and why it is important?

Debt-To-Income Ratio or DTI in simple term means, all your monthly debt payments divided by your gross monthly income. DTI ratio is important because it helps lenders to analyze your ability to manage your finances. It can specifically analyze your monthly payments to repay the loan.

#howtogetamortgagewithlowincome

Keep your loan options open

Like investment, you have to always keep your loan options available. Try to learn and understand the different types of loans available and what they have to offer. Before going to a traditional mortgage loan lender or Institution, search up government sponsored special loans programs which are specifically designed for lower income group.

Opting to apply through these programs will help you to save your money. Also, they make the loan process quicker as it may not require you to produce documents which may cause a hindrance if you apply for a normal mortgage loan.

Getting all the required documents ready

This is probably the most important step before you fill up your application. Getting all the required documents in advance will help you save time. In addition, it makes it easier for you to prepare yourself before you meet up with the lender. The documents that you may need for the mortgage are:

- Pay slip from the past month

- Tax returns of the previous year

- Bank statements of the past few months

- Other important documents such as, your credit card and loan reports, proof of your assets and so on

However, note that, some of these documents are only valid for applying in a typical standard mortgage loan Institution. If you are applying through special loan programs, you need not provide documents such as credit score report or your DTI statements etc.

These steps however do not guarantee that your loan application will be approved. At the end of the day, your loan approval lies entirely on the basis of which types of loan you have applied and under which authority you have availed the mortgage.

Traditional lenders are stricter in nature. Therefore, they may refuse to sanction your loan if you don’t meet their certain eligibility requirements provided. In addition, some may reject the loan application based on previous multiple loans and high-interest debts taken by you.

What are the types of mortgage loan options available for low-income group?

For a low-income borrower, finding the right mortgage loan is always a difficult task. This is because there are not many lenders willing to take the risks when a borrower with low paying job comes to apply for the loan. The reason is simple; it is because they have doubts whether or not the borrower would be able to repay back the loan taken. Before we get into the types of mortgage options available for low income, it is important to know the types of mortgage loans. They are:

- Home Loans

- Commercial property loans and

- Loans against properties

Having said that, the following are some mortgage loans initiated by the government and some private companies to facilitate the needs of the low income group:

1. USDA Loan

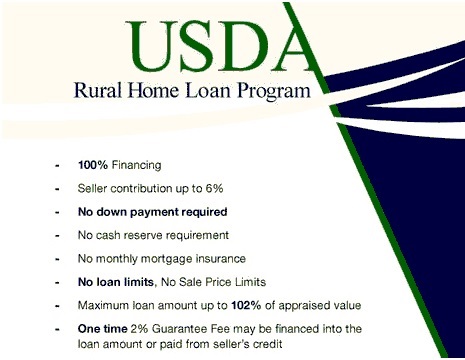

The full form of USDA is United States Department of Agriculture. USDA Loans are a zero down payment mortgages for homebuyers in rural areas. These loans are generally for borrowers with low income and are unable to get the typical traditional mortgage. The USDA loans are issued through the USDA loan program.

It also known as the USDA Rural Development Guaranteed Housing Loan Program by the USDA. This is to facilitate mortgage loan for eligible rural homebuyers. This program is to improve the quality of life of Rural Americans. With its low interest rates and absence of down payment, one may easily apply for this loan even with little money in your account. #howtogetamortgage

USDA Loan programs consists of three types:

- Loan Guarantee

Under this, the USDA guarantees a mortgage issued by a participating local lender with low interest rates, without a down payment. However, if the borrower puts little to no money down, they have to pay a mortgage insurance premium.

- Direct Loans

These loans are for the lowest income group applicants, issued by the USDA. Under this, the interest rates of the loans are as low as 1% with subsidies. This program is also known as Section 502 loans [s]. It is eligible for the borrowers whose income is too low to avail of other loan programs. A borrower has to make sure that, they don’t qualify for a standard USDA loan before applying for a USDA Direct loan.

- Home improvement loans and grants

These types of loans are issued to homeowners wanting to upgrade or repair their homes. And this comes with a loan and a grant for further financial assistance.

FAQs on USDA Loan

An applicant has to meet four eligibility requirements at the time of applying.

a) Citizenship Status: Applicants must apply their citizenship status and verify themselves as United States citizens, non-citizen nationals or qualified aliens.

b) Income eligibility: At the time of loan approval, the household’s adjusted income must not exceed the moderate-income limit.

c) Principal residence: As the program don’t avail loans for investment properties or temporary short-term housing, applicants must agree and have the ability to occupy the dwelling as their principal residence.

d) Adequate dwelling: The dwelling must be decent, modest, safe and sanitary.

The USDA program was introduced by the U.S Department of Agriculture through its Rural Development mission and the Farm Service Agency oversees the USDA loans.

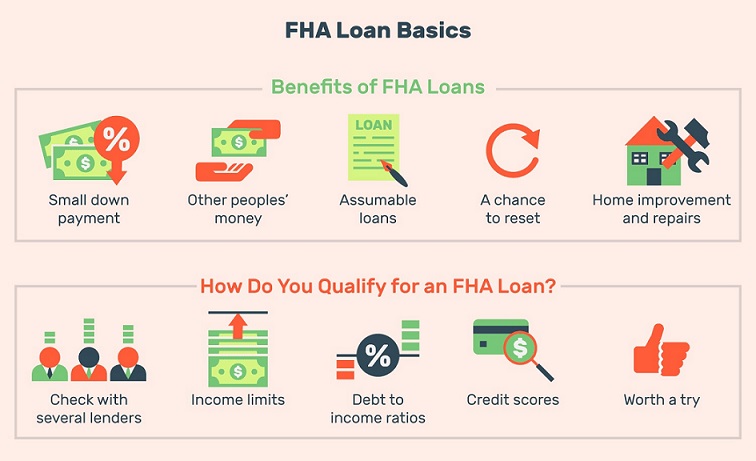

2. FHA Loan

FHA loan or the Federal Housing Administration loan is another government backed loan type by the U.S Department of Housing and Urban Development. It provides mortgage insurance on loans by FHA approved lenders to help the low income individuals purchase a home. #mortgage

As a low income home buyer, the down payment may be as low as 3.5%. It also facilitates the needs of individuals with low credit scores and also provides with more leniency in the debt income ratio requirements. The FHA Loan was introduced specifically for low income families. Under this program, we also have the FHA 203k, which allows you to take advantage of lower prices on fixer-uppers.

3. VA Mortgage

A VA loan is a mortgage offered through the U.S Department of Veterans Affairs program. If you are an active or veteran service personnel, you can avail for this low income mortgage loan option. It is also backed by the Federal Govt. but issued through private lenders. This loan requires a zero down payment. In addition, there is no monthly mortgage insurance, which means you can buy more homes even with low income.

And like FHA Loan, the VA loan also provides for more lenient debt income ratio and credit score requirements. However, to be eligible to apply for this loan, you are compulsorily required to have US military service experience. This experience also includes at least 90 days or more in wartime, 181 days or more in peacetime, 24 months or the full period for which you were ordered, and a minimum of 6 years if you are in the National Guard or Reserves.

Can a non service personnel apply for VA Loans?

The answer is no. VA loans were introduced specifically only for active and veteran service personnel and their surviving spouses.

4. HomeReady program

HomeReady program is a new loan program from Fannie Mae, which provides for a flexible sources of income. Under this program, an applicant can use the income of a family member to apply for the loan and the down payment requirement is just 3%. In addition, to qualify for the loan, you can even use a roommate’s income or just the co-borrower’s income.

5. Good Neighbour Next Door

The Good Neighbour Next Door program or the GNND is a special type of loan introduced by the U.S Department of Housing and Urban Development. It is specifically for the law enforcement officers, teachers and emergency personnel to avail loans and buy homes at a discounted rate of 50%. You can visit the GNND website, find a home and make your offer.

However, before your mortgage is sanctioned, you have to first prove that you are an approved public worker. If your application is accepted, this is a good low income mortgage option which allows you to only pay a 50% of the overall cost.

6. Down Payment Assistance

Down Payment Assistance is also known as PDA. It comes from various charitable and govt. organizations which eliminates years of saving for a down payment. It offers assistance to low income home buyers.

Under this, the HUD’s HOME Investment partnership program distributes funds every year to facilitate low income group to buy homes. However, note that, the buyers should not make more than 80% of the area’s median income. DPA funds can be used in combination with other types of loans. Therefore, you can contact a loan officer in your area for further information to combine your DPA assistance with the type of loan to avail that is of your interest.

Read about these 11 Simple Steps To Get A Beautiful Home!

Conclusion

All over the world, housing is getting more and more expensive due to limited resources available combined with overpopulation. The situation is even worse in urban areas like the cities or the major metro areas. For a low income individual, it takes years of savings and perseverance to even apply for a standard loan. That is why, the Government together with many charitable companies and NGOs have joined forces to assist the public with low paying jobs. So that, there is a better standard of living by giving out low to zero interest rates of loans, zero down payments, and financial grants and so on.

If you are a U.S citizen, you will find many mortgage loans available within your reach. Departments of the Government have introduced various of them specifically for low-income earners. You can search up in the internet about the various schemes and benefits available for this section of people. Also, check whether you meet the eligibility requirements and apply for it. Rather than trying to apply in a standard type of mortgage which you may or may not qualify due to your low income, availing yourself through these types of special loans will help you save hundreds or even thousands of dollars.

Frequently Asked Questions [FAQs]

What is a Mortgage Loan?

A mortgage loan is a type of secured loan where you can avail funds by providing your assets as collateral to the lender.

Can I get a mortgage loan with low credit score?

Yes and no. Depends on which types of mortgage loan you are availing. For example, if you are applying through government backed special loans programs for low income group, your credit score will not matter however, if you opt for the more standard method like, going to the bank or any other financial institution, you will need to provide your credit report and if your credit score is low, chances are that, your loan may be rejected.

What is Debt-To-Income Ratio and why it is important?

Debt-To-Income Ratio or DTI in simple term means, all your monthly debt payments divided by your gross monthly income.DTI ratio is important because it helps lenders to analyze your ability to manage your finances. It can specifically analyze your monthly payments to repay the loan.

Can I apply for government backed mortgage loans and schemes even with low income?

Yes, you can. In fact, there are many mortgage loans available for the low income group with extremely low to zero rate of interest and zero down payment.

Where can I find special loan schemes and benefits available for the lower income group of people?

You can either search it up on the internet or contact a loan officer directly and ask for the options available.

What is a Section 502 Loan?

Section 502 Loan is a type of direct loan issued under the USDA program for the lowest income group whose income is too low to avail other loans.

Can I use my DPA funds with other loans?

Yes, you can. DPA funds can be used in combination with many standard types of loan.