Table of Contents

Introduction

A loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose or payment while putting a lien on the property being mortgaged is known as a mortgage loan or in simple words, mortgage.

Mortgage is a word derived from a Law French term used in Britain in the Middle Ages. This means “death pledge” and it refers to the pledge that ends when either the obligation is fulfilled or the property is taken through foreclosure.

Mortgage origination is a process where the loan secures on the borrower’s property. A legal mechanism is put into place which allows the lender to take possession and sell the secure property or to pay off the loan in the event the borrower defaults on the loan or if he/she fails to abide by the terms. It can also be described as a borrower who gives consideration for a benefit in the form of collateral.

Mortgage Loans, Borrowers, and Lenders

Individuals who mortgage their homes can be called as mortgage borrowers. Business that mortgage commercial properties like their own business premises, residential property given for rent or an investment portfolio can also be mortgage borrower.

While the person or the place from where the borrower borrows money can be a typical financial institution like bank, credit union, or building society. And they are called lenders.

Mortgage loans depend on the country and arrangements can be made through intermediaries directly or indirectly. There is variation in terms of the size of loan, interest rate, method of paying off loan, and other features.

For instance, if the borrower becomes bankrupt or insolvent, the other creditors will only be repaid the debts owed to them through a sale of the secured property if the lender is first repaid in full.

There are two ways to fund mortgages. One is through banking sector which is short term deposits. And the other is through the capital markets by a process of securitization.

Securitization is a process that converts pools of mortgages into fungible bonds that could be sold off to the investors for small amount.

Basic Concept of Mortgage Loans

Before going for mortgage loans, one should understand its basic concept and the legal regulation that follows. A mortgage happens when an owner pledges his or her interest as security or collateral for a loan. So, a mortgage is an encumbrance on the right to the property as an easement. However, many mortgages takes place as a condition for new loan money. Therefore, the word mortgage has become the generic term for a loan secured by such real property.

In many countries, in order to finance private ownership of residential and commercial property, mortgage lending becomes the primary mechanism. Every country has different forms and features to carry out mortgage loans. However, the basics components may be a little similar though. In the case of property, the form of ownership will be different in each country and there may be certain restrictions in the types of lending.

In the case of mortgage, restrictions may be in the requirements to purchase home insurance and mortgage insurance and to pay off the outstanding debt before selling off the property.

Borrower may be a person who borrows and either has or is creating an ownership interest in the property. The lender can be a person but it is usually a financial institution.

They may also be investors who own an interest through a mortgage-backed security. The actual size of the loan which sometimes is inclusive or exclusive of other cost is the principal. When the principal is repaid, the principal will eventually go down in size. Interest, a financial charge for use of the lender’s money is prevalent in mortgage loans.

Redemption

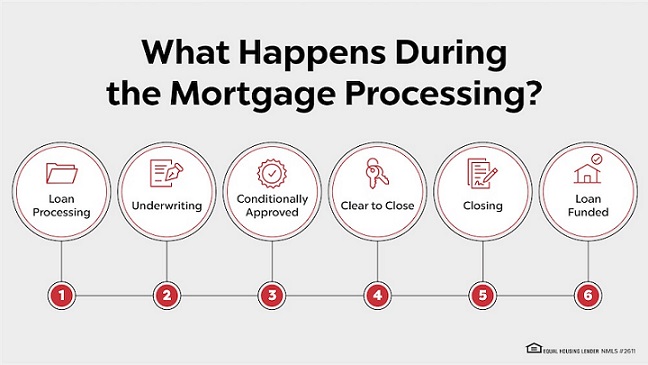

Redemption is the repayment of the final amount outstanding which could also be a natural redemption. It can be at the end of scheduled term or a lump sum redemption when the borrower intends to sell off the property. The basics of mortgage includes underwriting.

A mortgage loan underwriter verifies the financial information provided by the applicant. This includes income, employment, credit history, and the value of the home purchase during the loan approval process.

Mortgage Insurance

Another thing to keep in mind is mortgage insurance. It is an insurance policy designed to protect the lender also known as the mortgagee from any kind of default by the borrower or also known as the mortgagor. Mortgage insurance is most commonly used in loans with a loan-to-value ratio of over 80% and should be employed in the case of foreclosure and repossession.

The borrower pays for this policy as a component to final nominal rate, or in lump sum or even as a separate and itemized component of monthly mortgage payment. Mortgage insurance can be dropped when the lender informs the borrower that the property has appreciated. And, that the loan has been paid or loan-to-value has been relegated under 80 %. Banks and other investors should resort to sell their property to recoup their original investment. And then they are able to dispose of hard assets by price reduction in a much quicker pace.

How To Repay A Mortgage?

There are variations in how the cost is paid and how the loan itself is repaid. There are two standard means of setting the cost of mortgage loan at a fixed interest rate but there are certain differences. Locality, tax laws, and prevailing culture are the factors that determine the repayment.

Principal and interest

The most common and popular way to repay is to make regular payments towards the principal and interest over a set time. Interest may be calculated on the basis of 360 day year format. For instance, interest may be compounded daily, yearly, or semi-annually. Prepayment penalties may apply too. The term depends on the size of the loan and the current practice in the country. The term may be for 10 years short or it may be for 50 years long. The repayments are mostly interesting during the initial days and as the mortgage comes to an end, payments are mostly for principals.

Only interest

Interest-only is the only alternative to principal and interest mortgage where the principal is not repaid throughout the term. This type is very common in the United Kingdom and they usually associates with regular investment plans. Investment-backed mortgages are at higher risk because they are dependent on the investment that makes sufficient return to clear the debt.

Reverse Mortgages

It may be possible for some older borrowers to actually arrange a mortgage where neither the principal nor the interest repays. Principal and interest both roll up together and the debt increases every year. This type of arrangement or rather adjustment is known as the reverse mortgage or it is also known as lifetime mortgages. Until the borrower dies, the loans are typically not repaid and thus comes the question of age restriction.

Interest and partial principal

A partial amortization or the balloon loan is one where the amount of the monthly payments which are due are calculated over a certain term. However, the outstanding balance on the principal is due at some point shorter of that term.

Foreclosure and non-recourse lending

If for example in some jurisdiction a situation occurs, then the lender may foreclose the mortgaged property which means principally, non-payment of the mortgage loan.

The property may be sold only after some local legal requirements. Specific procedures for foreclosure and sale of the mortgaged property apply and tightly regulate by the government in all jurisdictions.

Learn How To Get Approved For A Mortgage Loan With Low Income

8 Tips To Lower Mortgage Payment

Lower interest rate refinance

Lowering or decreasing interest rate can minimize your burden. It can also give you an extra breathing room for your budget. You need to really keep an eye on the market if you are looking to lower your mortgage payment. Look out for rates that are much lower than your current interest rate.

Refinance Your Home Loan and Lower Your Monthly Mortgage Payment!

Avoid mortgage insurance

Mortgage Insurance come in with quite an additional sum of money to your already existing monthly payment. Getting rid of your mortgage insurance depends solely on what type of loan you have.

Mortgage term extension

If you wish to go for lower payment then the answer is to extend the term of your loan. If we think logically, a longer mortgage term spreads out the loan balance over more payments.

Appeal property taxes

You will probably be paying for your property taxes as part of your monthly mortgage payment if your account on your mortgage is an escrow. Your property taxes will depend on the basis of tax assessment conducted by your county. The value of your home and land will be determined by the assessor.

The condition is, if the assessor values your home on a high rate, you will for sure end up paying more taxes than what you actually need to pay. You can check the amount of assessed value of your property by visiting your local county recording office’s website or you can check your tax bill. You can always raise your voice or protest against it if you think that your home overvalues. If your assessment reduces, you are likely to pay lower property taxes, and with it comes a lower monthly mortgage payment.

Rent out extra space

If your home is bigger than you need and there is extra space available then you can make use of that part by renting it out. This way you can also reduce the cost of your monthly mortgage payment. It will be a loss if you just keep it like that so why not utilize it?

Federal loan modification programs

Federal loan modification programs are available for you to choose from. It will be able to help you if you are facing some financial crisis and you really need to cut down your mortgage payment. However, there are certain conditions and eligibility criteria that you must meet. The federal loan modification program can help reduce your short-term or long-term mortgage payment.

Get rid of PMI by paying upfront

You get the option to pay your private mortgage insurance upfront at the time when you close on your home. So, you can simply take care of the PMI. You can do so by paying a one-time fee rather than having to pay extra year after year on your mortgage.

Go for interest-only mortgage

There are some lenders that give you the chance by offering you an interest-only loan. And, you need not begin paying off your balance right away.

The two stages where interest-only mortgages occur are:

- the first phase where you only have to pay the interest on your mortgage

- and the second phase, you will have to pay off the actual principal balance plus interest.

For instance, if you have a 30 year mortgage and you pay only the interest in the first five years, your monthly payment may seem quite low, but the rest of your mortgage should pay off in the remaining 25 years. However, interest-only mortgages are a temporary means to lower your burden and it can work as long as you plan to increase your payments after the interest-only phase is over.

Conclusion

There are many ways and means through which you can lower your mortgage payment. But before you go for one, make sure you first decide whether you should go for a long-term solution or a temporary short-term solution. You can also lower your mortgage payment either by:

- avoiding mortgage insurance

- refinancing lower rate of interest

- opting for interest-only mortgages

- appealing property taxes, etc.

You can go for other available options provided you meet certain conditions and eligibility requirements. Make the right and suitable decision on how you can lower your mortgage payment. We hope this article was helpful for you.